Namely Recommended: Quarter End Payroll and Tax Validation Guide

This article will provide a checklist that you can use to guide your quarter-end auditing work around your payroll and taxes.

OVERVIEW

There are a number of important data points and reports we recommend reviewing in Namely Payroll in advance of your quarterly tax filings. We recommend using the last few weeks of the quarter to complete an audit of your company's tax information, and submit any needed corrections prior to approving your last pay cycle of the quarter.

Reviewing this data will help you avoid potential inaccuracies in your tax filings, which can lead to penalties and interest owed. This review can also help ensure a seamless release of W-2s for the tax year.

The below checklist provides an overview of the items we recommend validating on both the employee and company level. This article provides more detailed instructions to guide you through the checklist.

Refer to this document for more information: Quarter-End Payroll and Tax Validation Checklist

VERIFYING YOUR EMPLOYEE INFORMATION

Quarter close is a good time to review your Employee Information for accuracy in Namely Payroll. We recommend reviewing the following items prior to quarter close:

-

Check to make sure all employee Social Security Numbers and addresses are correct.

-

Review tax withholding setup for employees:

-

Do all employees have the correct home and work locations?

-

Is Dual-State Taxation set up correctly?

-

This information can all be viewed on your employee's individual profiles in Namely Payroll.

VERIFYING YOUR EMPLOYER INFORMATION

It's best practice to review your company-level information at quarter close as well. Go to Namely Payroll > Company > Tax to review the following items:

-

Is all of your legal company information up to date?

-

Are your taxes set up correctly?

-

Do you have Tax IDs for all jurisdictions?

-

Are Pay Frequencies correct?

-

Do you have the correct tax rate entered for all jurisdictions?

-

-

Are your SUI rates correct?

ENSURING TAX WITHHOLDINGS ARE UP TO DATE

Employees are encouraged to perform a Paycheck Checkup as recommended by the IRS in order to help ensure that they are contributing the correct amount to their individual Federal, State and Local taxes. This checkup will help them avoid any surprises when they file for their tax return next year.

Recommended items an employee should review includes the following, via Namely HRIS > Paystub:

-

Check to make sure the Form W-4 is up to date for Federal Taxes.

-

Verify the State Withholding information is accurate.

-

Review the information for any major life event changes, such as marriage, childbirth or adoption.

Note: This checklist for employees can be found in Keeping Up With Your Tax Withholdings.

VALIDATING TAXES AND W-2 WAGES

Once you've verified the above information is up-to-date, we recommend running a number of reports that can help you identify tax and wage discrepancies that may require your attention:

W-2 and 1099 Preview Reports

-

Employer W-2s (Copy D) - All

-

Payer 1099 (Copy D) - All

Quarterly Tax Reconciliation Reports

-

Quarterly Tax Reconciliation (Company)

-

Quarterly Tax Reconciliation (Employee by Check Date)

-

Quarterly Tax Reconciliation (Employee by Quarter)

Downloading the Reports

These reports can all be found by going to Namely Payroll > Reports.

To access the W-2 and 1099 Preview reports:

-

Click Reports > Quarterly and Year End.

-

Select the appropriate tax year for your review.

-

Click either the Employer W2s (Copy D) - All to review W-2 employees or Payer 1099 (Copy C) - All to review 1099 employees.

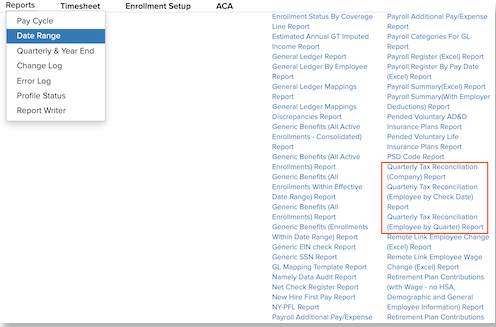

To access the Quarterly Tax Reconciliation reports:

-

Click Reports > Date Range to access the three Quarterly Tax Reconciliation reports.

-

Select the appropriate Year and Period for your review.

-

Download each report from the CSV Reports section.

TIP:

Using a Control+F (for PC) or Command+F (for Mac) search for "Quarterly Tax" will help locate the report.

W-2 and 1099 Preview Reports

The Employer W-2s (Copy D) - All and Payer 1099s (Copy C) - All reports contain a draft copy of your company's tax documents in IRS format. We refresh these reports each evening, and the report contains a time stamp noting the date it was last refreshed. These reports are helpful for identifying issues on an employee's W-2 or 1099, and reviewing them will help you avoid amendments, W-2cs and tax penalties.

Potential Discrepancies

-

Employee withholding tax in wrong state

-

Incorrect withholding amounts

-

Improper mappings in box 12 and 14

-

Incorrect taxable wages

-

Improper pay type code mappings

-

Important if you're using pay type codes other than salary and hourly - you'll want to make sure they're taxed correctly in boxes 1, 3 and 5.

-

-

Incorrect company information: Address, Name, FEIN.

TIPS

-

This report can be run as frequently as you'd like - as noted, it is refreshed each evening. If you had to file amendments and W-2cs in past tax years and would like to be more prepared this year, routine W-2 checkups are recommended.

-

In addition to running this report quarterly - we recommend running it after each payroll you run in December to ensure that any year-end changes have enough time to be processed and included on your W-2s.

-

Previewing an employee's W-2 who has undergone a change that could impact their W-2 (moved states, changed their name) enables you to verify the impact in real time.

-

Previews can be securely shared with employees. This is helpful for verifying that legal names, Social Security Numbers and addresses are correct before W-2s are filed. Previews can also be shared with employees upon request to provide them with peace of mind, so they can ensure their withholdings are correct.

-

The W-2s and 1099s contained in these reports should not be used for filing and will be watermarked as such.

Quarterly Tax Reconciliation (Company)

The Quarterly Tax Reconciliation (Company) Report contains taxable wages and data on taxes withheld, totaled for the entire company and broken down by tax type. The report will help you identify where there may be tax discrepancies that need investigating. We recommend reviewing these columns:

-

Review the list of taxes in Column C to confirm that there are taxable wages and taxes withheld for all states where you have employees.

-

Taxable Wages and Total Tax (i.e., taxes withheld) appear in Columns E and F, respectively, and should be reviewed.

Potential Discrepancies

-

State unemployment taxes: If there is a tax for which you have taxable wages, but no taxes withheld, you may have discovered an issue. It is possible that taxes are owed, or that an employee moved mid-year and met the taxable wage base in their previous state.

-

Any withholding taxes: If there is a tax for which you have taxable wages, but no taxes withheld, you may have identified an invalid tax code setup. You should verify that you have business nexus in this jurisdiction and that wages are correctly applied to that jurisdiction.

If you've identified any potential discrepancies, the next two reports can help you drill down to the root causes of the discrepancy.

Quarterly Tax Reconciliation (Employee by Check Date)

This report, along with the Quarterly Tax Reconciliation (by Quarter) report is helpful for drilling down into discrepancies identified in your review of the Company-level report.

This report displays all of the taxable wages and taxes withheld for each employee, with a break down by pay check, providing granular look at the data. We recommend following these steps for a successful audit:

-

Find the column in the report for the relevant taxable wages (for which you believe the taxes are incorrect.)

-

Filter to show any employees who have had those wages.

-

You will then be able to quickly see all employees, their taxables wages, and any taxes withheld for that tax type.

-

Calculate expected taxes withheld by adding in a column with a formula to calculate taxable wages * the appropriate tax rate.

-

Compare the result with the actual taxes withheld, according to the report.

-

For example, if you believe there is a discrepancy in your Arkansas Unemployment Tax, you can search for Arkansas Unemployment taxable wages, identify which employees had taxable wages in this category, take their Arkansas Unemployment taxable wages, multiply by the appropriate Arkansas Unemployment Tax rate, and see where the expected numbers do not match the reported numbers.

Quarterly Tax Reconciliation (Employee by Quarter)

Similar to the above report, the Quarterly Tax Reconciliation (Employee by Quarter) report is helpful for identifying potential issues found at the company level.

This report displays all of the taxable wages and taxes withheld for each employee, with amounts totaled for the entire quarter, for a summary overview of employee-level data. We recommend following these steps for successful audit:

-

Find the column in the report for the relevant taxable wages (for which you believe the taxes are incorrect.)

-

Filter to show any employees who had those wages.

-

You will then be able to quickly see all employees, their taxables wages, and any taxes withheld for that tax type.

-

-

Calculate expected taxes withheld by adding a column with a formula to calculate taxable wages * the appropriate tax rate.

-

Compare the result with the actual taxes withheld, according to the report.

-

For example, if you believe there is a discrepancy in your Arkansas Unemployment Tax, you can search for Arkansas Unemployment taxable wages, identify which employees had taxable wages in this category, take their Arkansas Unemployment taxable wages, multiply by the appropriate Arkansas Unemployment Tax rate, and see where the expected numbers do not match the reported numbers.

-

TAX VARIANCE FAQS

Please see the following FAQs for more information on tax variances- i.e., the possible causes behind any discrepancies you identify in your review of the reports outlined above, plus additional information on how Namely handles collecting funds to cover any observed variances.

What causes tax variances?

Tax variances are commonly caused by:

-

Rate changes

-

End-of-quarter adjustments made following the final payroll of the quarter.

-

Example: Adding wages and taxes to be recorded in the quarter- or an adjustment to an employee taxed in the wrong state.

-

Adjustments done by Namely while preparing for quarter-end filing.

-

You can help prevent variances by making rate change updates as you receive notices from tax jurisdictions (see: Adding and Editing Company Tax Codes and Rates in Namely Payroll), and following our Payroll Processing Validation Best Practices.

If a tax variance was caused by a rate change, and Namely has updated the rate, where can I find the new rate?

The new rate is listed under the Company > Tax tab in Namely Payroll.

When are funds collected to resolve tax variances?

Collections occur approximately two weeks after the quarter closes. If you are unable to fund variance money owed, we will contact you and ask for the funds to be wired to us for payment. If wiring is not possible, we'll attempt to collect funds on your next scheduled payroll.

If none of these funding methods are possible, payment may be late to the agency and penalties and interest may be assessed, which would be your responsibility to settle.

CASE SUBMISSION INSTRUCTIONS

If you've identified an issue with your taxes, you'll want to open a case in the Namely Help Community to ensure proper filing. Make sure to include:

-

The particular tax type for which you are seeing the discrepancy.

-

Any employees you believe to be the source of the discrepancy.

-

Any taxable wages or taxes withheld amounts that you need to be updated for these employees.